As the height of the pandemic continues to recede, contractors still face several ongoing issues, including sky-high materials prices and staff shortages.

“With 2021 in the rearview mirror, signs are pointing to stronger growth for the construction sector in 2022,” says Richard Branch, chief economist at Dodge Construction Network. “However, prices for construction materials continue their ascent and skilled labor has become even more scarce, meaning construction projects are taking longer to break ground.”

Julian Anderson, president of Rider Levett Bucknall, agrees. “Uncertainty is rising as everyone involved in the process tries to juggle getting the work done …against a backdrop of a [potentially] post-COVID world, in which interest rates are set to rise, and Russia upends global stability with its invasion of Ukraine.”

Related link:ENR 2022 1Q Cost Report PDF

Subscription Required

He adds: “This leaves owners having to make decisions about whether to go ahead with their projects, reduce scope or shelve them. In many cases, contractors are no longer willing to take on the risk of cost escalation and are putting that risk back on owners.”

Branch notes that non-residential building projects are taking roughly six months longer to begin construction than in 2019, which he expects to continue. “The Ukraine conflict, and its impact on energy and raw materials prices, complicates the situation and will likely lead to even higher prices and more project delays in the months to come.”

今年前两个月,道奇报告the dollar value of construction starts rose 14% over the same time period last year. Residential work rose 20% in the first two months of 2022, largely in the multifamily sector. “Single family activity has been weak as higher materials prices and mortgage rates weigh on the market. Multifamily construction, however, has taken its place posting aggressive growth,” says Branch.

Non-residential starts in the first two months of the year increased 39% over this time last year, as office and hotel work begin to rise again. Transportation and education activity also experienced increases, but the “real start” is manufacturing, says Branch. “Domestic producers are expected to seek more control over their supply chains in the future, so that aspect of construction should continue to flourish.”

In the non-building sector, starts have stayed flat over the first two months of 2022. Branch expects activity to rise as funds from the Infrastructure Investment and Jobs Act are distributed.

在材料方面,第一季度预测for S&P Global Market Intelligence (formerly IHS Markit) predicts a 14.6% drop in softwood lumber in 2022, following a 41.9% increase in 2021. This marks a significant change from the 2021 fourth quarter forecast, which predicted 29.2% decline this year. “Near-term supply-demand imbalance is the main driver of current price spikes,” says Deni Koenhemsi, associate director at S&P Global Market Intelligence. “While pandemic-related supply shortages are over, weather-related logistical difficulties persist, preventing lumber to reach buyers in a timely manner. This in turn creates panic buying and higher prices.”

Plywood is following a similar pattern, according to S&P Global Market Intelligence. The 2021 fourth quarter forecast predicted a 30.6% drop for 2022 year after soaring 46.2% in 2021. The current first quarter forecast has amended this to a more modest 17.8% decline.

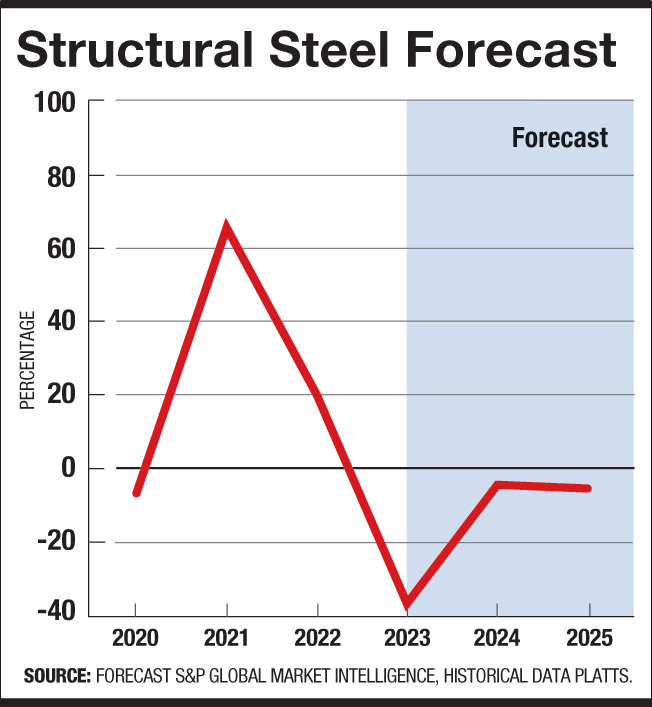

For steel, “everything has changed since the previous forecast,” says John Anton, director of steel at S&P Global Market Intelligence. “The Russian invasion of Ukraine reversed all downtrends.”

S&P Global Market Intelligence’s revised forecast, updated March 15, predicts a 22.1% increase for rebar in 2022, with a 20% boost for structural shapes.

“Products that fell in late 2021/early 2022 are moving back up and may regain their peaks. Prices that had not fallen much but were expected to drop are now expected to move sideways or even increase,” says Anton. “To put it simply, prices in 2022 will challenge the peak prices of 2021.”