行业交易经纪人表示,由于19日,由于COVID-19,没有合并和收购协议被取消,但该病毒已将刹车置于交易的速度和寻求的意图。。

行业交易经纪人表示,由于19日,由于COVID-19,没有合并和收购协议被取消,但该病毒已将刹车置于交易的速度和寻求的意图。。

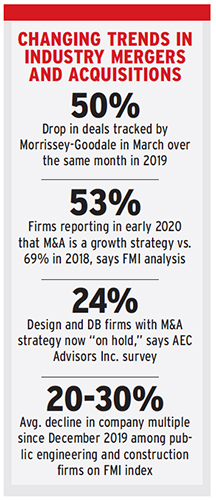

“Dealmaking started the year at a record-breaking pace, with a 25% increase in announcements over the same period in 2019,” says Mick Morrissey, partner at New England financial consultant Morrissey-Goodale LLC, referring to design firm deals it tracks. Transactions in March fell 50%, he says.

The firm said on April 20 that "for firms considering a sale, receiving a federal Payroll Protection Program loan could complicate matters down the road."

AEC Advisors Inc. 4月17日的COVID-19更新调查中,在280家设计和设计建设公司的首席执行官中,有43%的人说交易现在是“搁置”的,或者在后面燃烧器上,这两个类别均匀分配。

总部位于纽约市的财务顾问总裁安德烈·阿维利尼(Andrej Avelini)表示:“对收购的需求似乎可能会下降,但一些公司正在寻求更具侵略性。”通过这场危机。”

Steven Gido, a principal at deal adviser Rusk O’Brien Gido + Partners, points to a “pencils down mentality” now in some firms related to M&A, with a focus on “internal organizational needs … and a hope to pick up things in the early summer.”

他说,在其他公司中,“谈判仍在渗透,但强度较低”。

Alex Miller, managing director of FMI Capital Advisors, says, “For deals that do get done in the near term, we expect diligence periods extending as buyers increase scrutiny of potential acquisition targets.” He predicts more interest in infrastructure and public works firm as potential buys.

Gido and others still see big unknowns in 2020 industry revenue and profit forecasts because of COVID-19 as well as impacts from falling multiples of large public firms.

[For ENR’s latest coverage of the impacts of the COVID-19 pandemic, click here]

但是,吉多说:“病毒不会永远持续下去,并且有巨大的刺激,”下半场篮板“可能相当戏剧化”。他说,许多AEC公司正在陷入这场危机……具有记录的积压,因此他们可以根据自己所处的部门骑行。”

Some see the current prevalence of private-equity buyers as a key difference in M&A activity now compared to the 2008-09 recession.

“Those guys will keep buying because of lower valuations in the short term,” says one M&A broker, who contends that 20% of all AEC transactions now involve private-equity financing.