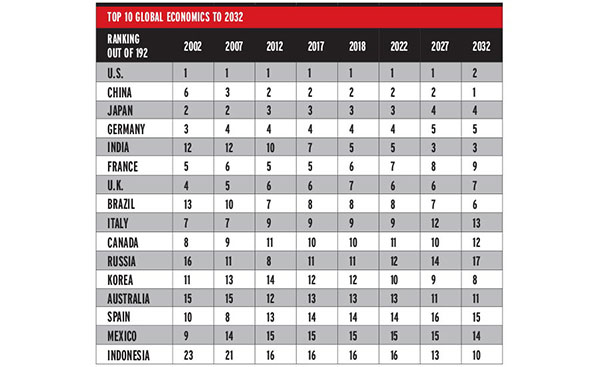

Following a slow down in worldwide construction output last year, 2018 will to start a long period of growth, reaching 15% of total GDP by 2032, according to a new forecast. Established Western nations will be increasingly overshadowed by emerging economies, with China overtaking the U.S. in GDP.

根据2018年世界经济联盟餐桌的数据,在接下来的十年半中,中国和印度将有助于塑造全球建设现场,该餐桌刚刚由伦敦经济中心与全球建筑观点(GCP Global)发行。

WELT2018 charts growth prospects and GDP rankings in U.S. dollar values to 2032 for nearly 200 countries representing virtually 100% of the global economy

中国的全球建筑影响力将主要通过其带有各种土地和海上贸易路线的带腰带和道路倡议。Welt2018说,同时,该国的国内建筑市场似乎正在削弱,尤其是在住房部门。它指出,2017年的基础设施投资“保持强劲”,但建筑的较长期限“不鼓励”。

India’s vast infrastructure and rural development plans will also drive longer term output global, note the forecasters. Among the most ambitious plans is the $100 billion Delhi-Mumbai Industrial Corridor of 24 new cities along a roughly 1,500 km high-speed freight rail line. Vast sums of money are planned also for urban and residential schemes across the country.

在WELT2018的预测期内,印度将超过法国,德国,日本和英国,在中国和美国之后,在GDP中排名第三

在更加成熟的经济体中,美国的建设持续缓慢恢复,部分受到去年恶劣天气的阻碍。现场内外的劳动力和员工短缺可能会加剧劳动力的变化。预报员认为,预报员最早在2019年下半场之前不太可能在州和地方的地方层面上增加建筑活动,而特朗普总统的基础设施计划的影响”。

西欧的建筑产量在2017年的恢复性高于预期,尤其是在德国。预计今年和下一年的增长速度较慢,超越的前景较不积极。

在其他较大的欧洲市场中,法国的复苏去年加速了,预计将继续进行住宅建设。计划中计划的巴黎奥运会在2024年应加强长期需求。

Welt2018说,英国计划明年从欧盟出发的出发事件引发了伦敦新商业市场的崩溃。再加上“更广泛的(经济)不确定性”,英国的建筑产出看起来将在今年继续下降。

Scandinavian output, particularly in housing, continued rising last year and will likely continue at a slower pace.

西班牙建筑市场预计将继续增长,但危机后基地极低。意大利的复苏仍然迟钝,而去年的债务负债累累的希腊的产量随着主要公路项目的完成而减少了新利18备用网址

After a weaker 2016, output in many Eastern European countries increased last year. The “considerably stronger” markets in Poland and Hungary are expected to continue strengthening this year and next. The rate of decline in Russian construction output “slowed markedly” in 2017.

In South East Asia, rising populations and urbanisation will drive construction, says WELT2018. Infrastructure work will continue boosting Indonesian demand after a recent slow down. Construction output in the Philippines retains strong growth, driven by infrastructure, residential and commercial work and supported by housing and industrial and commercial output. Malaysian demand is expected to pick up after dipping last year.

In Australia, P3s will help underpin needed urban infrastrcutre investment offsetting declines in commodity-linked construction, according to WELT2018.

In Latin America, 2018 will herald widespread upswings in construction demand, says WELT2018. Argentinian demand last year “rebounded strongly” from declines in 2016. Brazil’s decline “may have troughed” while Colombia also shows sins of recovery.

In Africa, Nigeria and Egypt are recovering from big declines in construction output early in 2017. Algeria had a strong start to 2017, but weakened later in the year. The partial recovery in the oil prices during 2017 should, if sustained, boost many economies this year and next across Africa and also the Middle East.

Construction demand was particularly weak in Saudi Arabia in 2017, but has been slowly improving. The planned Expo 2020 exhibition is boosting demand in the U.A.E. But oil prices will govern the market. Construction activity has collapsed in war-torn Iraq and Syria but “once peace returns massive rebuilding will be required,” says WELT2018.