经济衰退不应该持续这么长时间,也不是如此。联邦刺激支出是为了使我们恢复繁荣,而不是仅仅改变金融灾难。但是,从悬崖上迈出几步可能是我们的刺激资金可以购买的最好的。几年前,数万亿美元的建筑市场现在似乎是一种幻想,每年800亿美元的市场可能是新现实。在泡沫的流行中,建筑市场的五分之一可能已经蒸发,使该行业进行了严重的调整。

市场已经从人工成本,材料价格和分包商利润率中挤出了一切。新利18备用官网登录但是,随着房屋的反弹浮动和非住宅建筑市场衰退的加深,似乎无处可去,无论上升还是下降。新利18备用官网登录

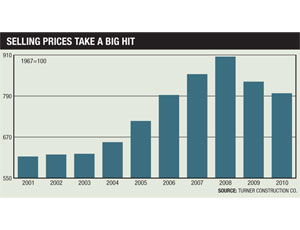

在这种环境下,建筑行业的选取ling cost and general-purpose indexes are starting to converge. The selling cost indexes, which, in part, reflect shrinking subcontractor margins due to competition, are starting to see year-to-year changes flatten out after a series of steep double-digit declines. For example, The Turner Construction Co.’s selling price index showed no change this quarter and is down just 2.7% from a year ago. A quarter ago, the Turner index posted an annual decline of 7.9%, while in the third quarter of 2009 it showed a year-to-year decline of 10.8%.

General-purpose building-cost indexes, which only measure labor and materials prices, are starting to ease back. For example, the LSI index compiled by the Sierra West Group, Sacramento, Calif., was down 2.6% from a year ago this quarter. By comparison, three months earlier, it posted an annual increase of 1.1%; a year ago it showed an annual inflation rate of 2.4%. The two series of indexes appear to be converging into the plus- and minus-2% range—not a wide spread by recent standards—indicating costs are indeed bottoming out.

If the Federal Reserve Board’s inflation target was 2%, then it surpassed expectations in construction.

“我们看到价格通货膨胀率很小,但是到它过滤到竞标价格时,这一切都被挤出了,” Rider Levett Bucknall Ltd的校长朱利安·安德森(Julian Anderson)说。RLB售价指数本季度上涨0.3%,但一年前仍低于0.5%。

“At the beginning of the downturn in the non-residential building market, we saw some large cost savings,” says Karl Almstead, vice president of Turner Construction Co., New York City, who is responsible for putting together that firm’s selling-price index.

As the volume of work dropped, the remaining workforce used more experienced workers, giving productivity a boost and lowering labor costs. At the same time, many subcontractors were slashing margins to win work, says Almstead. “We already have squeezed labor down as far as it is going to go, and the same holds for profit margins,” Almstead says. “There are really not a whole lot of options to go much lower and stay alive. … We are headed into a new reality and need to think about what a recovery will look like.

“我们无法返回不可持续的气泡,” Almstead补充说。他认为,可能需要第二轮刺激支出,以帮助消除市场的不确定性,直到行业“对其所处的位置感到满意”。

Several materials prices that initially rebounded along with the housing market earlier this year are starting to bottom out again as the housing recovery falters. “The upturn in housing was more a reflection of the homebuyers tax credit and was not an indication of market strength,” says Robert Martin, construction materials analyst for IHS Global Insight, Washington, D.C. “Lumber prices got a little ahead of themselves, and we see a correction in the next six months, with prices returning to where they were at the beginning of the year,” he says.

马丁说,水泥价格已经下跌了大约10个月,并且接近底部。“但是,鉴于非住宅建筑市场的疲软,我们认为直到一两年之后,我们才认为水泥价格没有取得巨大的收益。”他预测,到2013年第四季度,水泥价格仍将比其2009年的峰值低1.8%。

“Steel is grossly overpriced,” says John Anton, Global Insight’s steel analyst. By 2011’s first quarter, he expects rebar prices to fall 12.6% from the second quarter of this year. In the same period, he sees an 11.2% drop in structural-steel prices.